Summary of results

| € million | 2015 | 2016 |

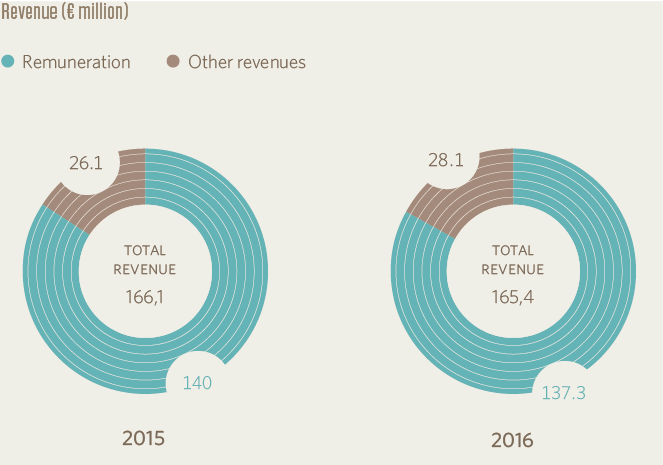

| Remuneration | 140.0 | 137.3 |

| Other revenues | 26.1 | 28.0 |

| EBITDA | 135.7 | 134.2 |

| EBIT | 102.0 | 103.1 |

| Net profit | 47.6 | 49.3 |

The energy scenario in which Madrileña Red de Gas operates requires the inclusion of the largest number of users possible with natural gas supply connected to their distribution networks. During this financial year, in Madrileña Red de Gas we have passed 850,000 supply points, increasing our position as the reference energy supplier.

Last June, Madrileña Red de Gas entered into a framework agreement with Repsol Butano for the acquisition of approximately 42,000 LPG supply points, which will make it possible, once converted to natural gas, to accelerate the expansion of the company and our distribution network, the basic strategic pillar of the company. In addition, in order to provide services to new municipalities of the Community of Madrid, MRG has expanded the gas distribution network to the municipality of Vellón and has launched two satellite liquefied natural gas plants to supply the municipalities of Valdetorres and Zarzalejo. We are currently providing a service to a total of 853,056 supply points.

One of the objectives of MRG is to continue to develop a sustainable business model, focused on the growth of the regulated distribution business; the increase in operational efficiency; the financial strength to take advantage of the growth opportunities in the market; long-term shareholder value and a strong social commitment that pursues the creation of value for all our stakeholders. During this financial year the regulatory measures applicable to the activity of natural gas distribution have already been implemented, and the fund for sustainability and control over the tariff deficit of the system is being maintained. Regulation is a key element in the sustainability of the activities of MRG, so as to attract the investments needed to secure and expand the distribution of natural gas in an efficient manner.

In this sense, this financial year, through the entry into the shareholder structure of Lancashire County Pension Fund, has seen the establishment, together with Gingko Tree Investment Ltd, PGGM and EDF Invest, of the consortium of shareholders which share the vision, the business profile of the company, the advantages that the penetration of gas in the national energy mix represents and its commitment to the long-term stability of the current regulatory framework. MRG represents for its shareholders an industrial project for value creation in the long term, and their confidence in the company allows us to have the necessary resources to further develop our project.

Operating results

In the financial year 2016, the results have been higher than initially expected, due to the good performance of the regulated businesses and the improvement of operational efficiency.

Compared to the previous year, the gross operating result (EBITDA) reached 134.2 M€ (- 1.1%) and the gross operating result (EBIT), adjusted for amortisation and non-recurring charges, reached 103.1 M€ (+ 1.1%). With respect to EBITDA, there is still an impact of the adjustment to the remuneration of the company as a result of the measures contained in the Royal Decree 8/2014. This negative effect has been partially offset by an increase in the volume of operations in regular inspections and by the increase in household operations aimed at improving the efficiency of the distribution network and reducing operating costs, through continuous improvement in processes and automation. All this, despite the impact of lower earnings, has made it possible to maintain a level of EBITDA similar to the previous year.

On the other hand, the EBIT operating results have increased to 103.1 M€, which represents + 1.1% compared to the figure for the previous year, mainly due to the reduction of non-recurring expenses and amortisation.

Revenue

The net turnover in the financial year 2016 was 165.4 M€. Out of total revenue, 83% comes from the fees for distribution activity, which are fixed under the Orders of the Ministry of Industry, Tourism and Commerce 2445/2014, published in Official Gazette No. 312 of 26 December 2014, 389/2015 published in Official Gazette No. 58 of March 9, 2015 and 2736/2015 published in Official Gazette No. 302 of 18 December 2015. The remaining 17% corresponds to other services related to the activity of natural gas distribution. The most important of these is revenue from the rental of meters, revenue from regular inspections and revenue from the provision of other services to users.

Financial position and balance sheet

Madrileña Red de Gas regards its financial strength as an essential pillar that allows us to maintain strong levels of solvency and liquidity ratios consistent with an investment grade rating, so as to balance the rise in debt with the generation of additional cash from new investments. The debt structure is compliant with the mandatory business profile.

In this context, during the third quarter of the financial year, a bond issue has been made for an amount of 75 M€ with maturities in March 2031. This issue was carried out by Madrileña Red de Gas Finance BV, a company domiciled in the Netherlands and owned 100 percent by the sole shareholder of MRG; it has received the rating of investment grade from the international rating agencies Standard & Poor’s and Fitch.

| € million | 2015 | 2016 |

| Gas distribution licences | 713.4 | 713.4 |

| Net tangible fixed assets | 367.3 | 355.8 |

| Total Network Fixed Assets | 1,080.6 | 1,069.1 |

| Goodwill | 57.4 | 57.4 |

| Deferred tax asset | 29.1 | 27.3 |

| Other non-current assets | 29.6 | 29.9 |

| Other current assets | 19.0 | 47.3 |

| Cash | 56.1 | 111.4 |

| Total Assets | 1,271.9 | 1,342.3 |

| Equity | 422.1 | 383.4 |

| Long term debt | 771.2 | 846.7 |

| Deferred tax liability | 26.9 | 30.4 |

| Other non-current liabilities | 1.2 | 1.3 |

| Current liabilities | 50.5 | 80.6 |

| Total Liabilities & Shareholders equity | 1,271.9 | 1,342.3 |

Cash flow from operations

| € million | 2015 | 2016 |

| EBITDA | 135.7 | 134.2 |

| Income tax paid | (18.3) | (12.0) |

| Working capital | 0.8 | (4.4) |

| Capex | (21.0) | (15.7) |

| Free cash flow | 97.1 | 102.1 |

The temporary increase in investment and changes in the regulatory framework for natural gas have the largest impacts on the generation of cash in this financial year.

The cash flow generated by operations during the financial year 2015 was 102.1 M€, an increase of 5% on the previous financial year.

The main factors that have contributed to the increase in cash flow are the improvement in the operating margin of the company, as a result of operational efficiency, through improvements and automation processes; the increase in other regulated revenues and the temporary decline of investment as a result of the agreement with Repsol to purchase approximately 42,000 LPG supply points; they will be converted to natural gas over the next few years.

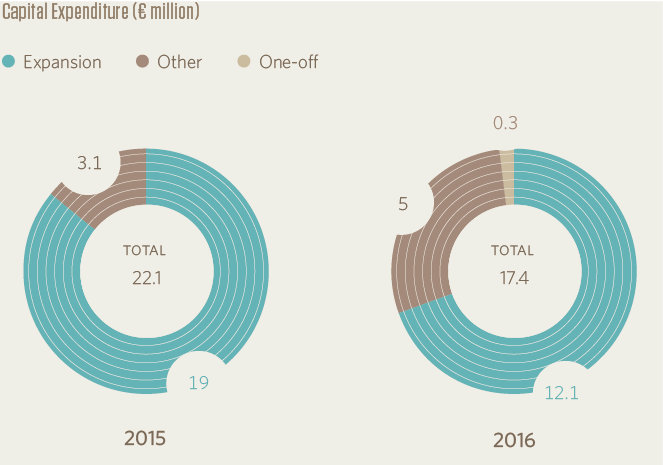

Investments

MRG has continued to roll out its investment plan, with the aim of expanding the distribution of natural gas to the maximum of consumers. Investment in fixed assets during the period reached a figure of 17.4 M€. In terms of their essential characteristics, investments or investment commitments in 2016 can be grouped in three major areas:

Expansion

Madrileña Red de Gas has invested a total of 12.1 M€ in the expansion of its distribution networks. The strategy of the company remains focused in the expansion of our distribution network, both through the connection of new customers within our territory and through its enlargement to new adjacent municipalities.

Also, and to provide a service to new users, the company has expanded the gas distribution network to the municipality of El Vellón and has since launched two satellite liquefied natural gas plants to supply the municipalities of Valdetorres and Zarzalejo.

Other projects

Investment in projects for the development of information systems and technical improvements in other areas of the company continue to be a focus within the investments of Madrileña Red de Gas.

Through these investments, MRG will continue to improve operational efficiency through advances in automation and digitalisation in all processes.

Acquisition of LPG plants

The conclusion with Repsol Butane of a framework agreement on June 9, 2016, for the acquisition of a total of approximately 42,000 LPG supply points, for conversion to natural gas, the efficient functioning of the operating assets and investment plan described above will lead to sustainable growth of the cash flow and results of the company in the coming years.